Back

17 Nov 2022

RBNZ seen raising rates by historic 75Bps

A Reuters poll sees the Reserve Bank of New Zealand hiking by 75Bps next week.

Stubbornly high inflation expectations reinforced the case for more aggressive rate hikes from the Reserve Bank of New Zealand.

The latest central bank survey showed that inflation expectations moved higher across the curve and the market is pricing higher rates, expecting a larger increment of 75 basis points next week after delivering a half-percentage point increase in October.

Meanwhile, RBNZ officials have been outspoken of late, explaining that high inflation and a tight labor market in the country call for demand to be cooled, though they flagged downside risks to the global economy.

NZDUSD update

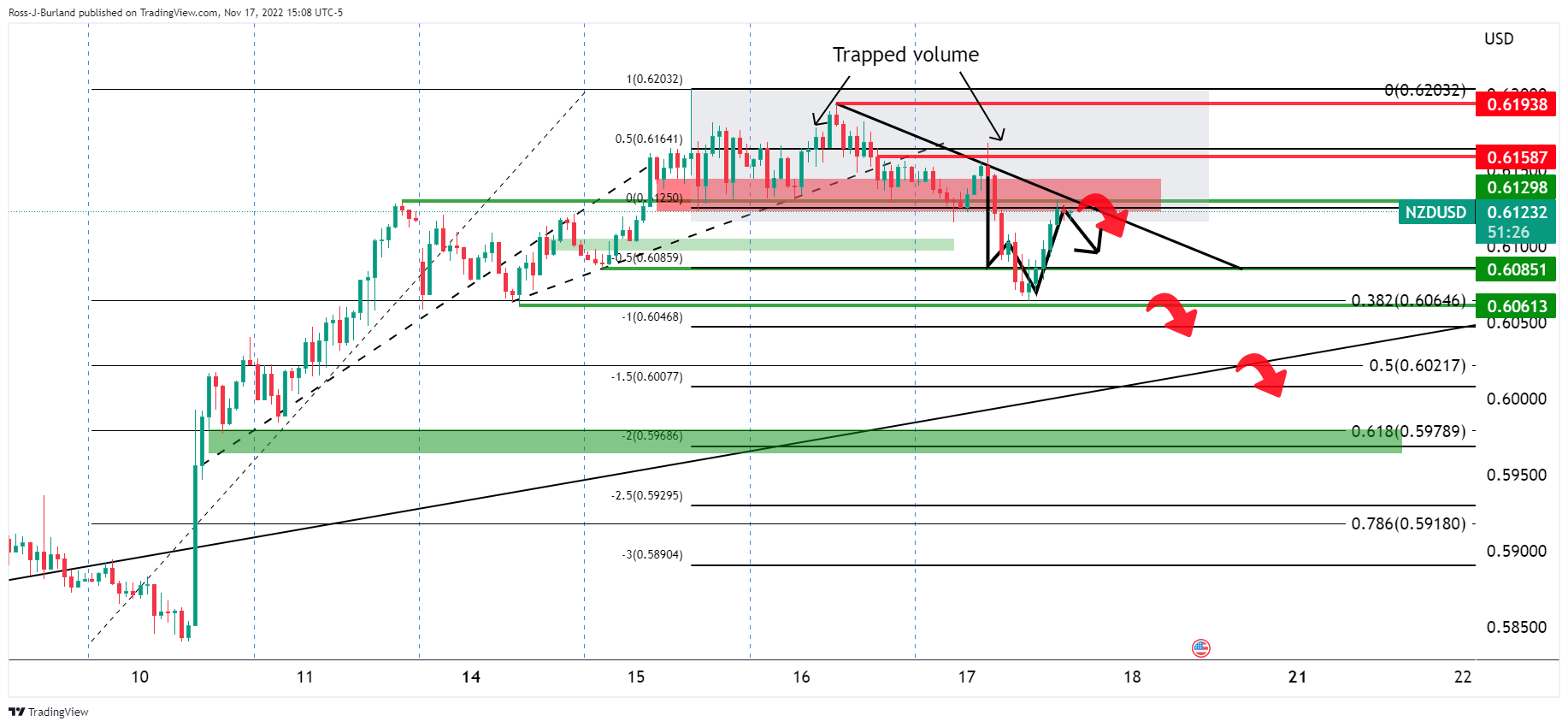

- With the price on the front side of the bearish trendline.

- W-formation is a reversion pattern that would be expected to be a drag on the recent rally.

- A retest of the lows could see a push below and on to the 61.8% golden ratio that aligns with prior support in a 200% measured expansion of the trapped volume up top.