Back

27 Sep 2023

Natural Gas Futures: Further consolidation in the pipeline

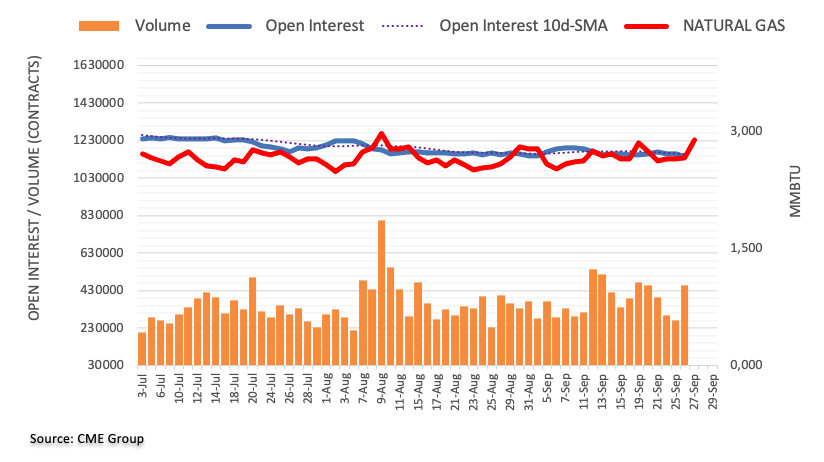

CME Group’s flash data for natural gas futures markets noted traders trimmed their open interest positions for the third session in a row on Tuesday, this time by around 16.5K contracts. On the other hand, volume rose sharply by more than 184K contracts after four consecutive daily drops.

Natural Gas: Next resistance aligns around $3.00

Prices of natural gas extended the uptrend on Tuesday amidst shrinking open interest, which leaves the door open to a corrective move in the very near term. However, the pronounced increased in volume could allow for the continuation of the uptrend. On the latter, the $3.00 mark per MMBtu remains the key obstacle for bulls for the time being.