WTI poised to challenge $60.00 ahead of API

- Prices of the WTI climbed to the boundaries of the $62.00 mark.

- WTI plummeted to the mid-$60.00s after hitting daily tops.

- Next on tap the weekly report on US crude stockpiles by the API.

Prices of the barrel of the American reference for the sweet light crude oil are now receding from the area of session tops near the $62.00 and return to the negative territory in the $60.50 area.

WTI now looks to the API report

Prices of the West Texas Intermediate are now retreating for the second session in a row, shedding over a dollar from yesterday’s weekly tops in the $62.40 region.

WTI remains under pressure amidst sour sentiment among traders in light of rising US crude oil production and US supplies in past weeks, as recently reported by the DoE. In this regard, US oil output has surpassed Saudi Arabia’s and is now approaching Russia’s, the biggest oil producer in the world.

That said, it is worth mentioning that the IEA said in its monthly report on Monday that the US crude oil production is expected to increase above 11 mbpd by year-end.

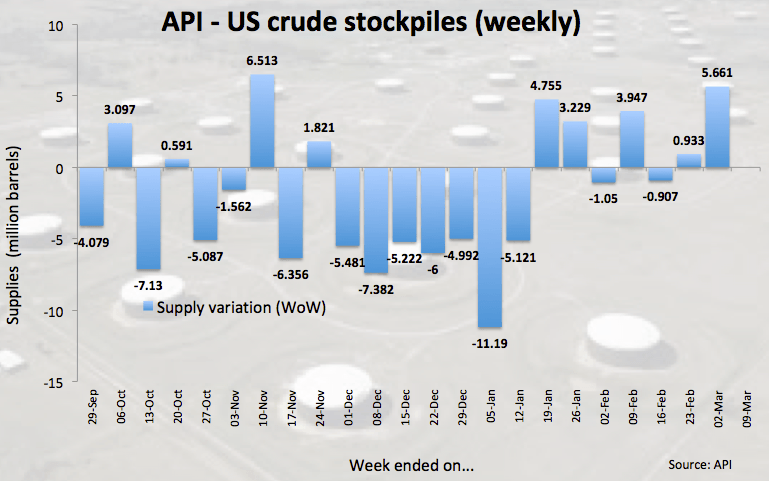

Looking ahead, the API will report on US crude oil supplies later today (+5.661 mbpd prev.).

WTI significant levels

At the moment the barrel of WTI is down 1.38% at $60.56 and a break below $60.03 (low Mar.8) would target $59.73 (100-day sma) and finally $58.10 (2018 low Feb.9). On the other hand, the next hurdle aligns at $62.35 (high Mar.12) followed by $63.31 (high Mar.6) and then $64.30 (high Feb.6).