Crude Oil: WTI bull party goes on as OPEC agreement is extended beyond 2018

- OPEC/Non-OPEC agreement is extended beyond 2018.

- The buyers have been relentless and prices are now flirting with $66.

Crude Oil WTI is trading at around $65.81 a barrel as it pulled back yesterday on China tariffs fears but the bulls came back as the Saudi Oil Minister declared that the Opec and Non-Opec agreement will likely be extended beyond 2018.

Al-Falih, the Saudi Arabia’s Energy Minister said “We still have some time to go before we bring inventories down to the level we consider normal and we will identify that by mid-year when we meet in Vienna. And then we will hopefully by year-end identify the mechanism by which we will work in 2019.” He also added: ”OPEC members will need to continue coordinating with Russia and other non-OPEC oil-producing countries on supply curbs in 2019 to reduce global oil inventories”, according to Reuters.

The other positive note for crude is that that the OPEC deal compliance was a whopping 138% in February, which was their best compliance to a deal ever recorded.

Also boosting the oil price this week was the inventory statistics of the API and EIA which showed a draw while analysts were expecting a build. Total inventories of -7 million barrels put oil stocks to 1% below the key 5-year average.

The nuclear arms race between Iran and Saudi Arabia as well as Venezuela oil production falling also contributed to support the black gold.

Morgan Stanley upgraded their oil price target to $82.50 for mid-year as an increase in seasonal demand in the coming month and geopolitical tensions are seen as positive factors for oil prices.

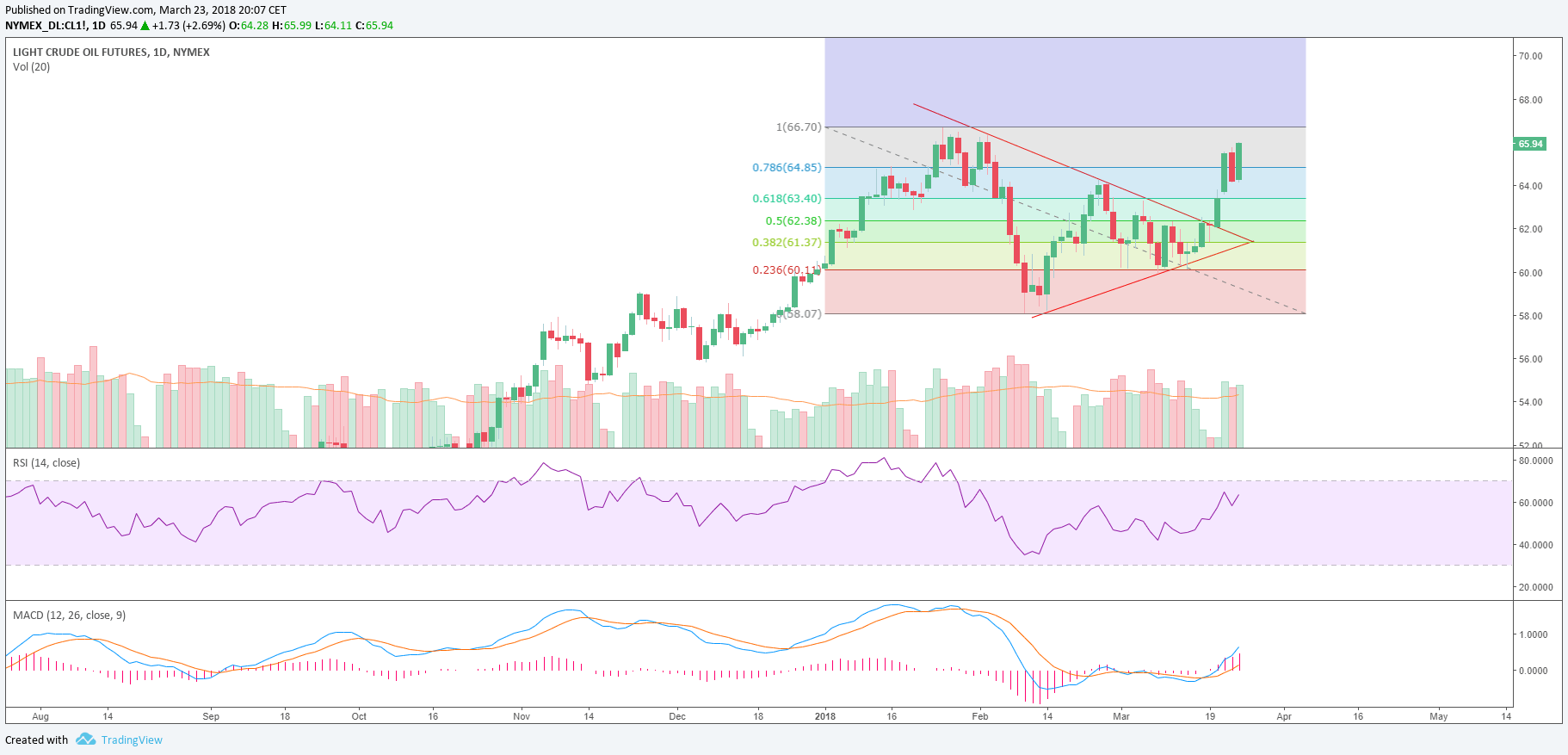

Crude oil WTI daily chart:

Next resistance is seen at 66.70, 2018 high; followed by the 70.00 figure which should act as a price magnet. To the downside, support is seen at 64.23 Thursdays' low; followed by 63.39 which is the 61.8% Fibonacci retracement from the January-February bear leg.