GBP/USD Review: Inside day as the Sterling loses momentum on renewed Brexit fears

- The Sterling fell away from recent highs as PM May's latest Brexit proposals drive Brexiteers to resign from their posts.

- Trade fears are once again the broader market's key driver, with the US-China trade war ramping up.

The GBP/USD is trading steadily ahead of Wednesday's London market session, sticking close to 1.3250 after marking an inside day for Tuesday.

This week's focus for the Sterling has been renewed Brexit concerns, with five key parliamentary Brexit ministers resigning from their posts in protest over Prime Minister Theresa May's latest Brexit proposal, which sees a last-ditch "third option" resolution to attempt to bring free trade for hard-line Brexiteers, but keep the UK under the jurisdiction of some EU laws, with PM May hoping to appease both sides of negotiations. EU leaders are unlikely to accept any proposals that put the EU at a disadvantage, and Brexiteers are seeking to retain all British sovereignty, even if it means a 'hard Brexit' scenario.

Wednesday brings little meaningful data for the Sterling, and traders will be focusing on resurging trade tensions as the US threatens to impose a further $200 billion USD worth of tariffs on Chinese goods, which has seen market sentiment stoop lower for Wednesday.

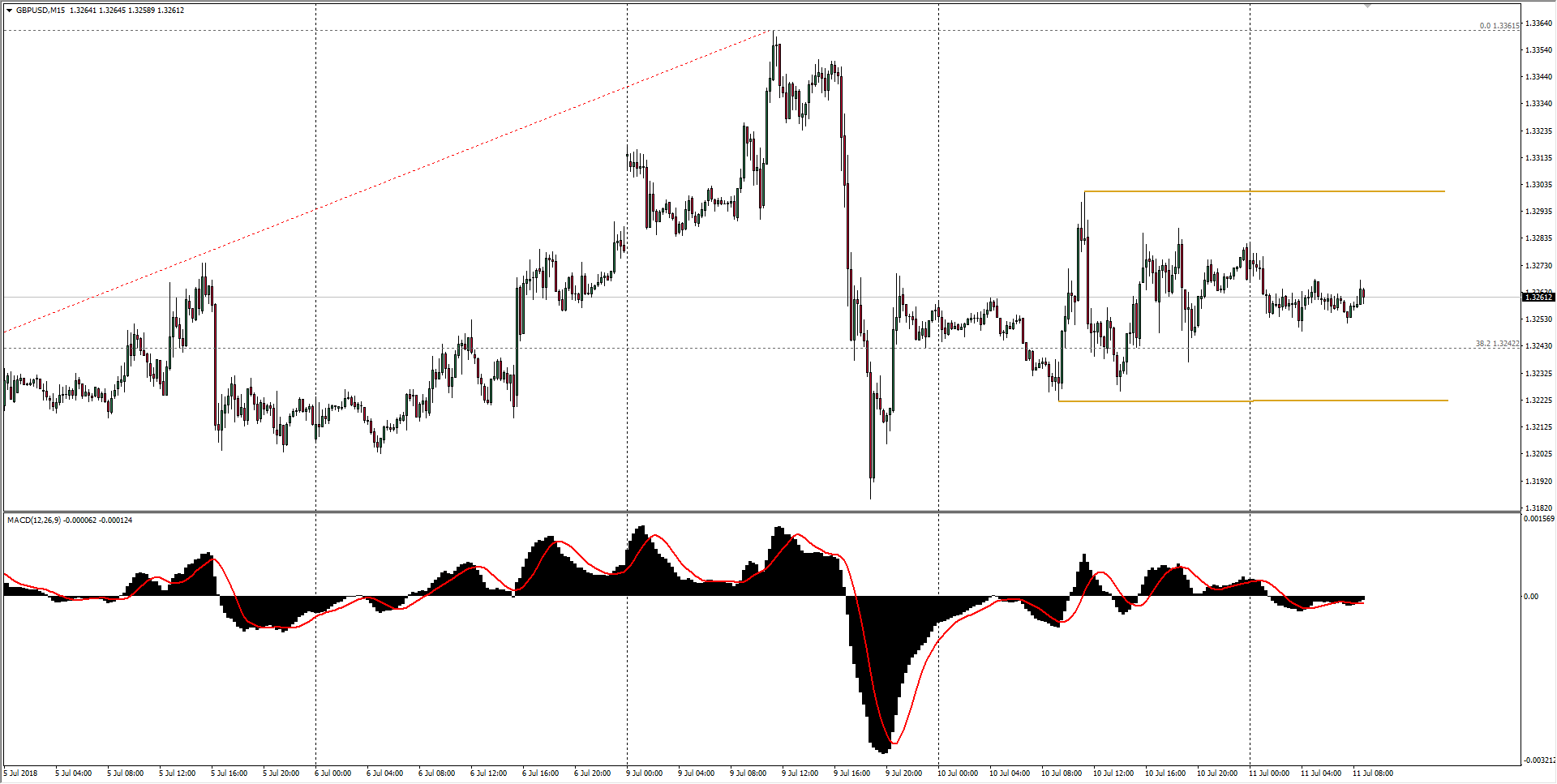

GBP/USD Technical Analysis

Sterling's sideways grind has produced an inside day, a key technical straddle opportunity for traders, and the GBP is leaning towards the bearish side as Brexit once again becomes the key headline driver for the GBP/USD.

| Spot rate: | 1.3261 |

| Relative change: | -0.09% |

| High: | 1.3281 |

| Low: | 1.3248 |

| Trend: | Sideways |

| Support 1: | 1.3222 (previous day low) |

| Support 2: | 1.3168 (61.8% Fibo retracement level) |

| Support 3: | 1.3094 (previous week low) |

| Resistance 1: | 1.3300 (major technical barrier) |

| Resistance 2: | 1.3361 (current week high) |

| Resistance 3: | 1.3446 (one month high) |

GBP/USD Chart, 15-Minute