Back

23 Jul 2018

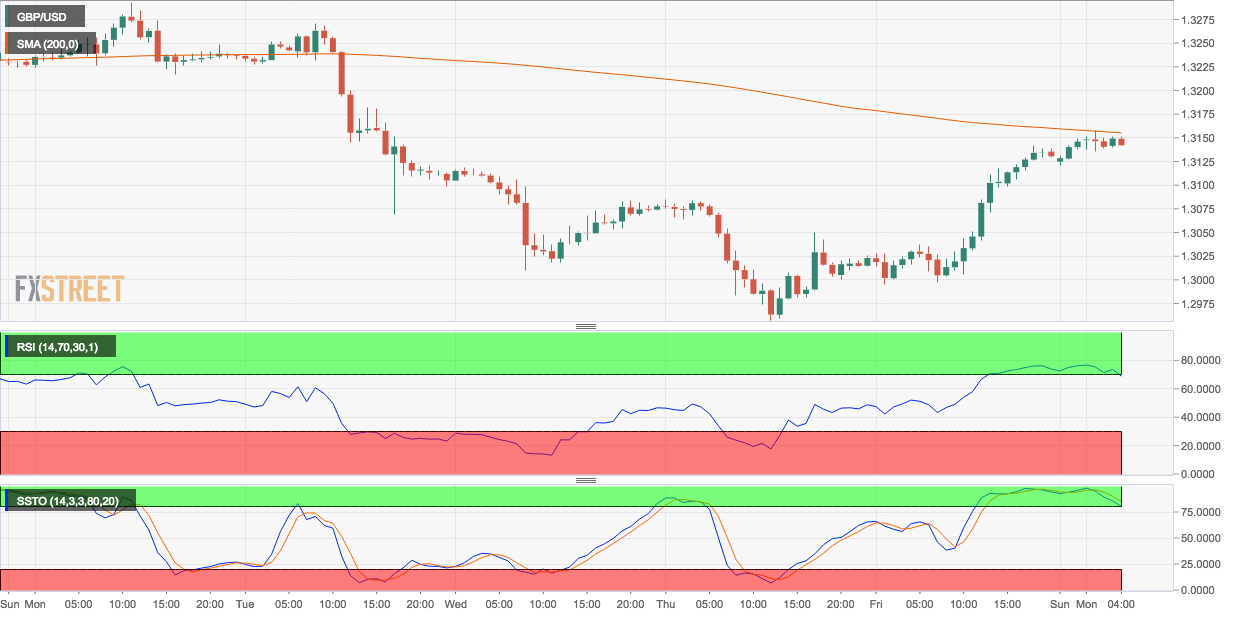

GBP/USD Technical Analysis: 200-hour MA hurdle could be a tough nut to crack

- GBP/USD hourly chart shows a bearish divergence of the relative strength index (RSI). The stochastic has generated a sell signal and is about to roll over from the overbought territory in favor of the bears.

- As a result, the resistance at 1.3155 (200-hour moving average) will likely hold at least for the next few hours.

Hourly chart

Spot Rate: 1.3144

Daily High: 1.3157

Daily Low: 1.3120

Trend: mildy bearish

Resistance

R1: 1.3162 (10-day moving average)

R2: 1.3276 (50-day moving average)

R3: 1.3293 (July 16 high)

Support

S1: 1.3120 (session low)

S2: 1.3190 (5-day moving average)

S3: 1.3089 (100-hour moving average)