EUR/USD bounces off lows near 1.1350 post-German data

- The pair is down smalls near the 1.1350 region.

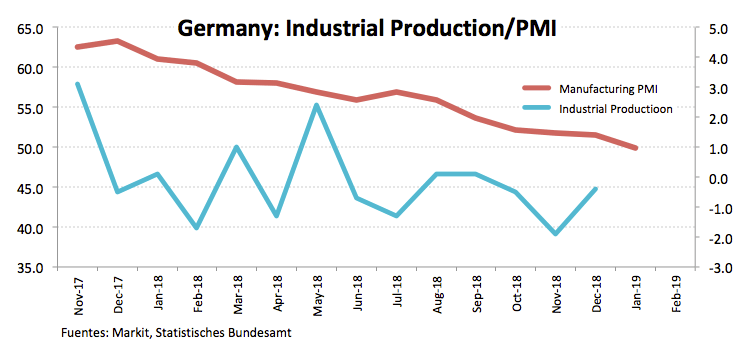

- German Industrial Production contracted 0.4% MoM in December.

- ECB’s Y.Mersch due to speak later in the session.

The selling bias around the European currency stays well and sound so far this week and is now forcing EUR/USD to trade in fresh 2-week lows near 1.1350.

EUR/USD weaker on USD-buying, data

Spot is now alternating gains with losses in the mid-1.1300s always against the backdrop of the generalized better sentiment surrounding the greenback.

Collaborating with the downside in EUR, German Industrial Production contracted at a monthly 0.4% during the last month of 2018, missing expectations and adding to the already sour mood in German/EMU fundamentals.

Looking ahead, ECB Board member Y.Mersch will speak at the American European Community Association in Brussels. Across the pond, Initial Claims are expected followed by the speech by Fed’s VP R.Clarida.

What to look for around EUR/USD

The extent and duration of the slowdown in Euroland continues to be in centre stage following recent figures from Q4 GDP in the bloc and the persistent negative streak from German fundamentals. On the political scenario, May’s EU parliamentary elections should start to gather relevance with the days, paying special attention to the potential advance of populism in the region.

EUR/USD levels to watch

At the moment, the pair is losing 0.01% at 1.1361 and a break below 1.3151 (low Feb.7) would aim for 1.1329 (200-week SMA) en route to 1.1289 (2019 low Jan.24). On the other hand, the next hurdle emerges at 1.1390 (55-day SMA) seconded by 1.1433 (100-day SMA) and finally 1.1442 (38.2% Fibo of the September-November drop).