Back

18 Jul 2019

EUR/USD technical analysis: Fiber leaps near weekly highs on Fed’s Wiliam dovish comments

- Fed’s William sent the US Dollar down across the board.

- EUR/USD is having a boost as it is approaching 1.1292 resistance.

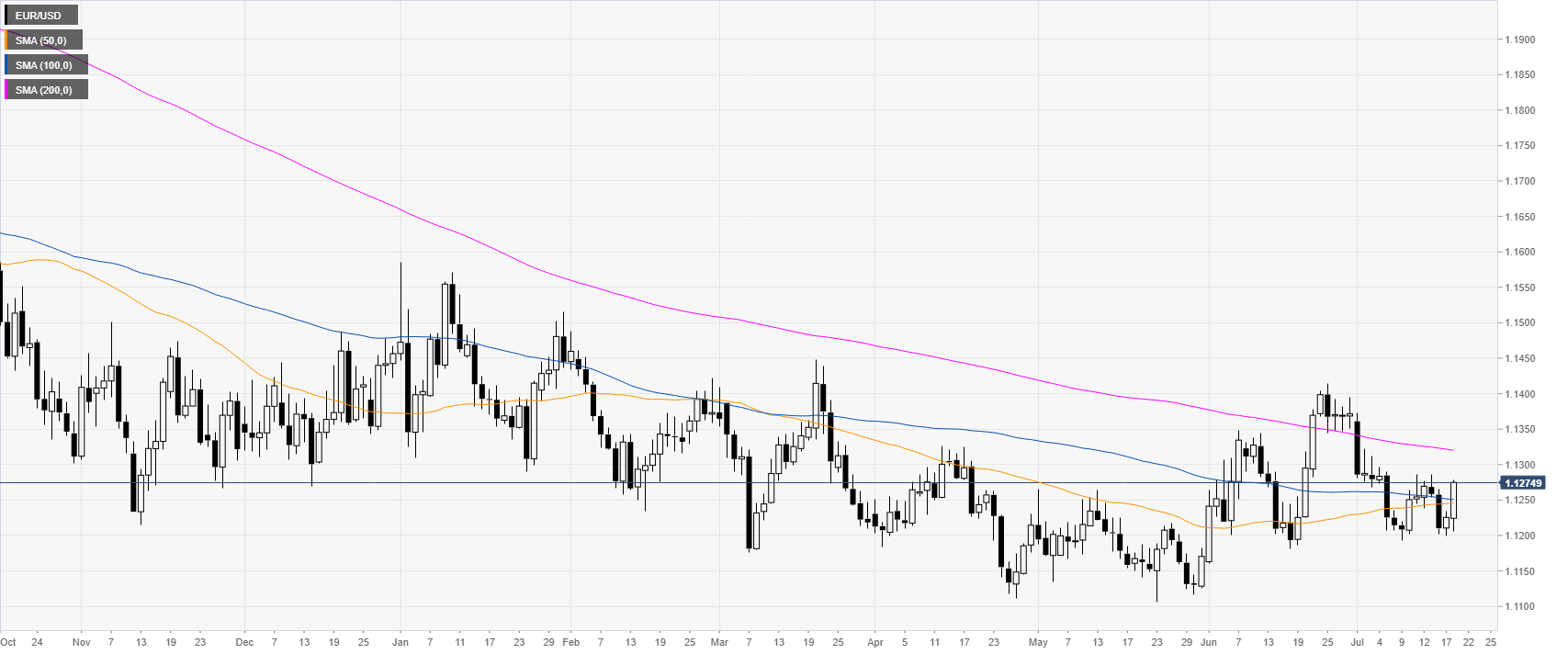

EUR/USD daily chart

EUR/USD is in a bear trend below the 100-day simple moving average (DSMA). The US Dollar fell across the board after Fed’s William said that is better to cut preventatively than to wait for a disaster.

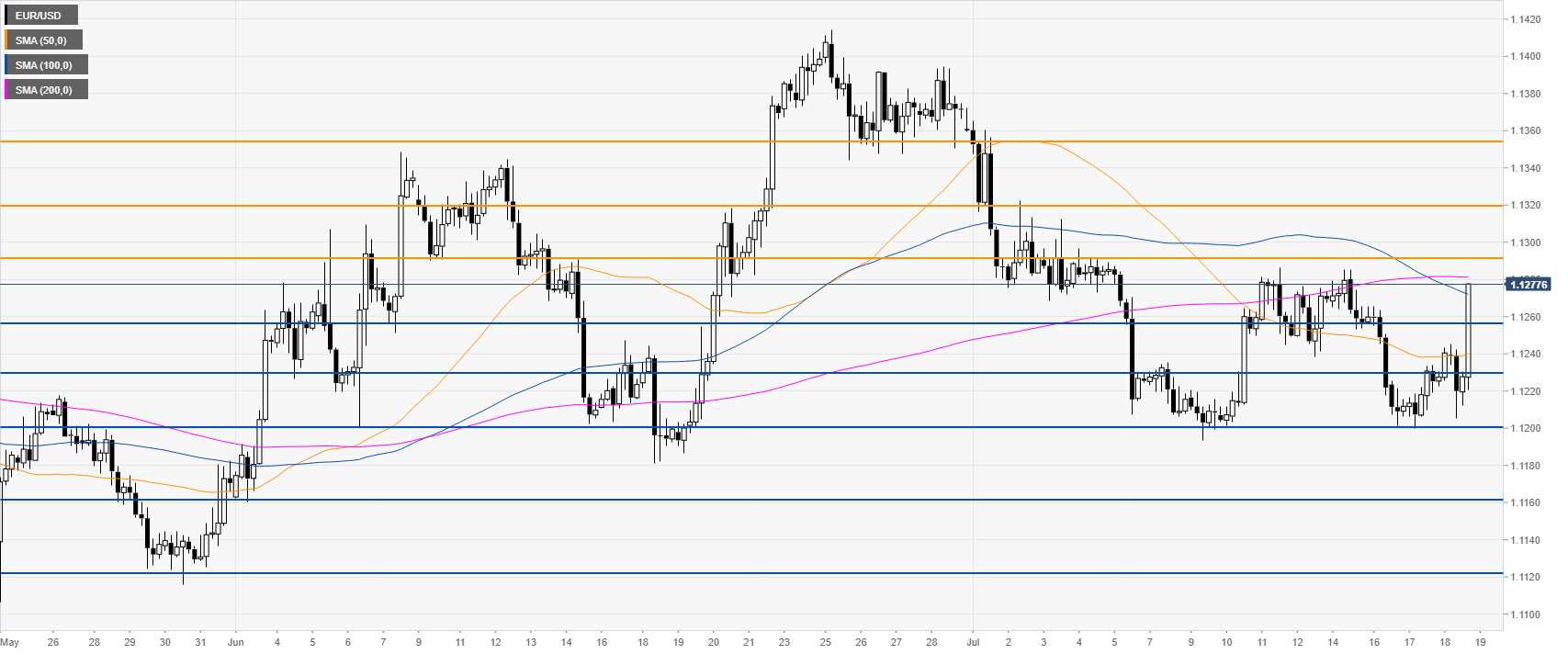

EUR/USD 4-hour chart

EUR/USD is challenging the 1.1280 level near the 100/200 SMAs, bulls want to break above 1.1292 and 1.1320 according to the Technical Confluences Indicator. Futher up lies the 1.1355 resistance.

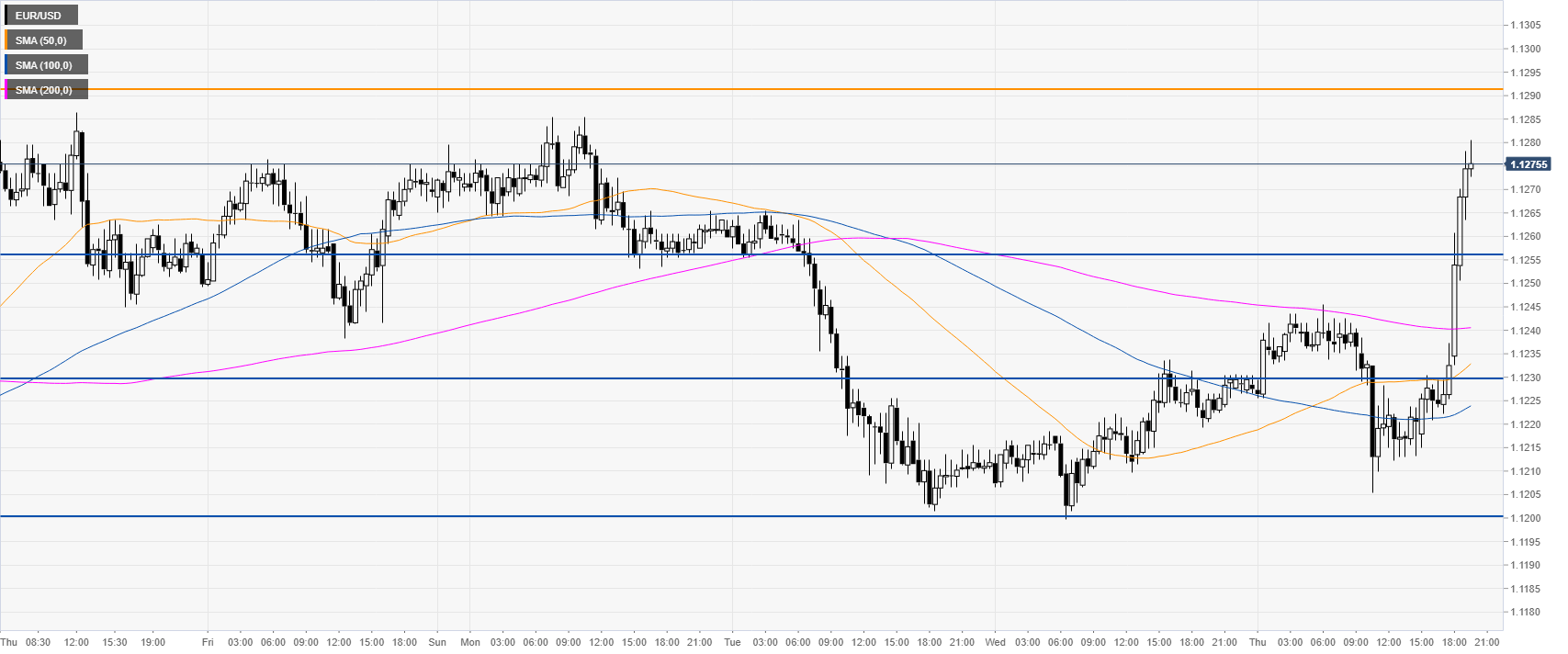

EUR/USD 30-minute chart

EUR/USD is trading above its main SMAs suggesting bullish momentum in the near term. Immediate support can be seen at 1.1256 and 1.1230, according to the Technical Confluences Indicator.

Additional key levels