Back

21 Aug 2019

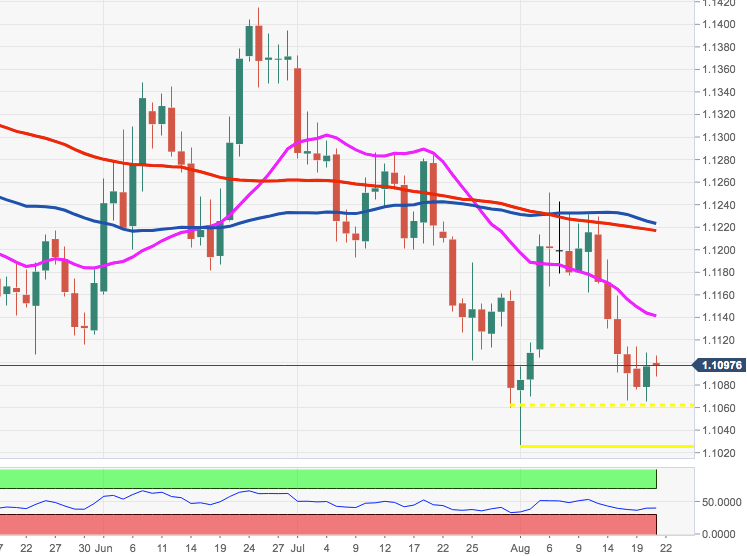

EUR/USD Technical Analysis: A breach of 1.1060 would pave the way for a test of 2019 lows

- EUR/USD is exchanging gains with losses in the 1.1100 neighbourhood today, as market participants wait for the FOMC minutes (later today) and Powell’s speech (Friday).

- Occasional bullish attempts are expected to met initial hurdle in the 1.1137/40 band, where are located the 10-day and 21-day SMAs ahead of a Fibo retracement at 1.1186.

- The downside pressure is expected to mitigate somewhat on a surpass of the 1.1215/49 region, where sit the 100-day, 55-day SMAs and monthly tops.

- If the selling impetus regains traction, recent lows in the 1.1060 area offer initial contention ahead of YTD low at 1.1026.

EUR/USD daily chart