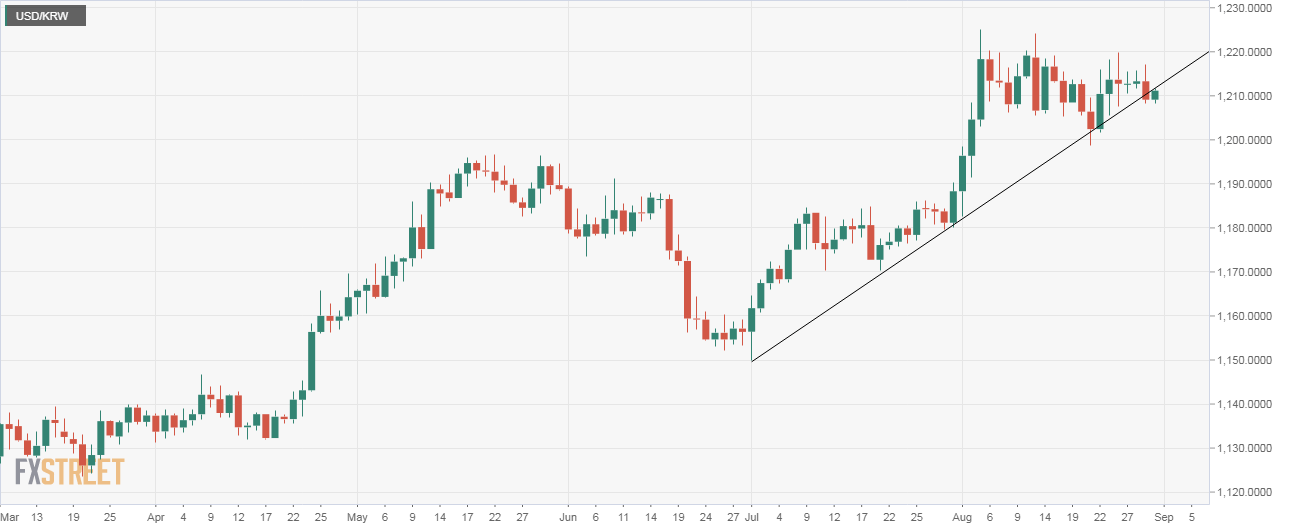

USD/KRW technical analysis: Rises to key trendline hurdle, BOK keep rates unchanged

- USD/KRW is revisiting former support-turned-resistance of a key rising trendline.

- USD/KRW created a bearish outside day pattern on Thursday.

USD/KRW picked up a bid around 1,207 earlier today and is now probing the resistance of the trendline connecting July 1 and July 31 lows. As of writing, the trendline hurdle is located at 1,210.

A strong rejection at the trendline hurdle and a drop below $1,207 (Thursday's low) would validate the bearish outside bar candlestick pattern created yesterday and invite stronger selling pressure, possibly leading to a drop to 1,199 (Aug. 21 low).

The Bank of Korea kept the interest rates unchanged at 1.5% earlier today. So, the pair could drop below $1,207 later today.

However, a majority of economists polled by Reuters expect the central bank to cut rates to a record low of 1.25% at the Oct. 17 meeting.

So, dips to 1,199, if any, could be reversed ahead of the BOK's October meeting.

Daily chart

Trend: Bearish below 1,207

Pivot points