Back

22 Oct 2019

EUR Futures: scope for a move lower

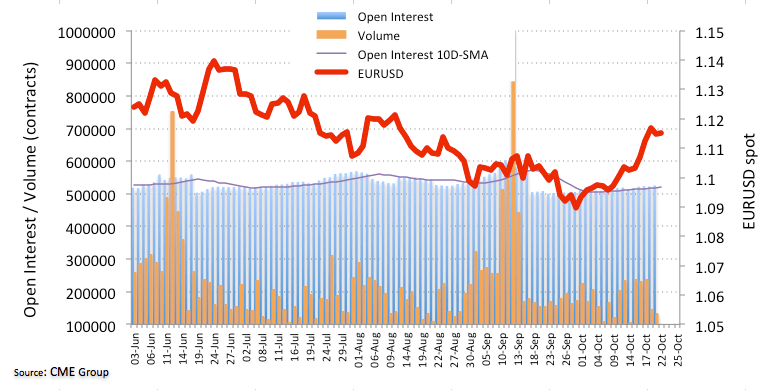

In light of flash data for EUR futures markets from CME Group, investors added nearly 3.4K contracts to their open interest positions at the beginning of the week. Volume, instead, shrunk for the second session in a row, now by around 11.3K contracts.

EUR/USD stays capped by 1.1180

EUR/USD shed some ground on Monday amidst rising open interest, which should open the door for the continuation of the correction lower in the next sessions. The move, however, looks limited against the backdrop of shrinking volume and could give way to some consolidation while a stronger catalyst for an extension of the up move turns up (or not) in the short-term horizon.