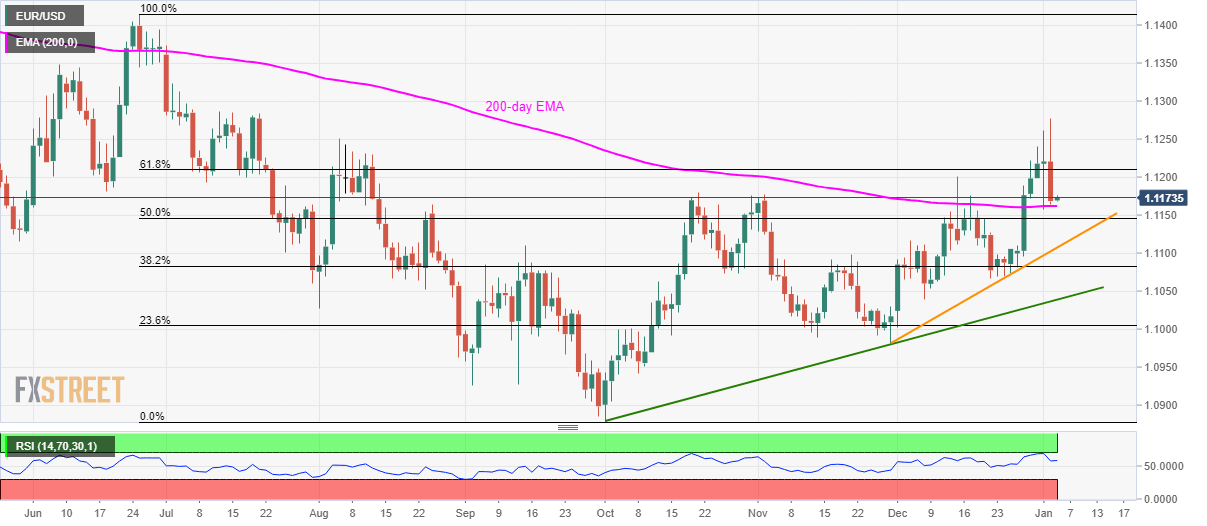

EUR/USD Technical Analysis: Sellers will look for entry below 200-day EMA

- EUR/USD remains in a choppy range just above the key EMA.

- 61.8% Fibonacci, multiple tops since early July guard immediate upside.

- The monthly trend line adds to the support.

EUR/USD is mildly up while keeping the short-term range as it traders around 1.1175 during early Friday. The pair dropped below 61.8% Fibonacci retracement of its June-October moves but 200-day EMA restricted its downside on Thursday.

Buyers are gradually piling up for the revisit of 61.8% Fibonacci retracement, at 1.1210. However, tops marked during early-July, around 1.1285 can question the Bulls afterward.

On the pair’s rise past-1.1285, 1.1300 and 1.1350 can offer intermediate halts to the rally targeting 1.1415.

Meanwhile, a daily closing below 200-day EMA level of 1.1160 can fetch the quote further down to 50% Fibonacci retracement level of 1.1145 and then to an ascending trend line since November 29, at 1.1107 now.

During the quote’s declines below 1.1107, the 1.1100 round-figure could act as a validation point for further declines.

EUR/USD daily chart

Trend: Pullback expected