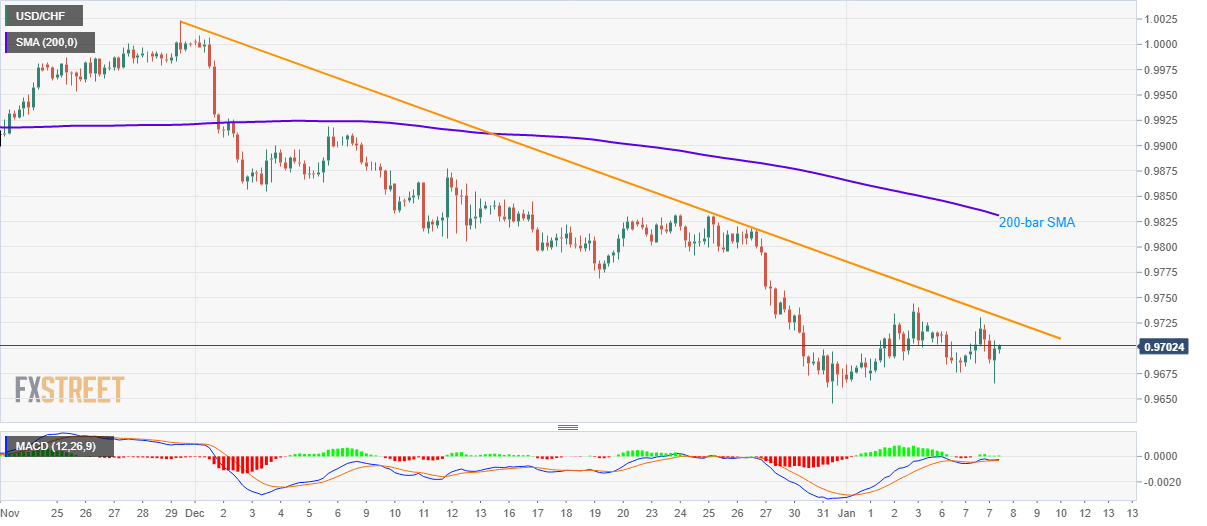

USD/CHF Technical Analysis: Weak below six-week-old falling trendline

- USD/CHF recovers amid the recent risk reset.

- 200-bar SMA adds to the upside barrier, 2019 low holds the key to further declines.

USD/CHF bounces off the intra-day low of 0.9665 to 0.9702 while heading into the European session on Wednesday. The pair benefits from the absence of immediate US-Iran war after Tehran hit US bases in Iraq.

Even so, the pair stays well below the descending trend line since November 29, at 0.9730, which limits the near-term advances.

Should the pair manages to clear 0.9730, it can rise to December 19 low near 0.9770. However, a 200-bar SMA level around 0.9830 could restrict the pair’s further advances.

In a case where the bulls dominate past-0.9830, 0.9920 and November month high of 1.0024 will be on their radars.

Meanwhile, 0.9660 and the year 2019 low near 0.9645 can limit the pair’s immediate declines, a break of which could set the tone for the pair’s fresh drop targeting 0.9600.

USD/CHF four-hour chart

Trend: Bearish