Gold Price Analysis: XAU/USD so far, so good for the bears

- Gold prices have rallied into a resistance area following a slide in the greenback.

- A bullish reverse head and shoulders could be in the making in the DXY, equating to a drop in gold prices.

So far, so good, according to Tuesday's analysis predicting weakness in the US dollar and enough strength in the price of gold to offer the bears a significant discount to get short of the precious metal.

For a quick recap, Tuesday's analysis was looking for the makings of a bullish reverse head and shoulders in the DXY, as follows:

-637382169582674280.png)

As it stands, the price action has gone according to plan:

-637382990422632042.png)

This has given rise to a sizeable discount in gold for bears to sell into strength, or fade the rally.

Fading gold's rally

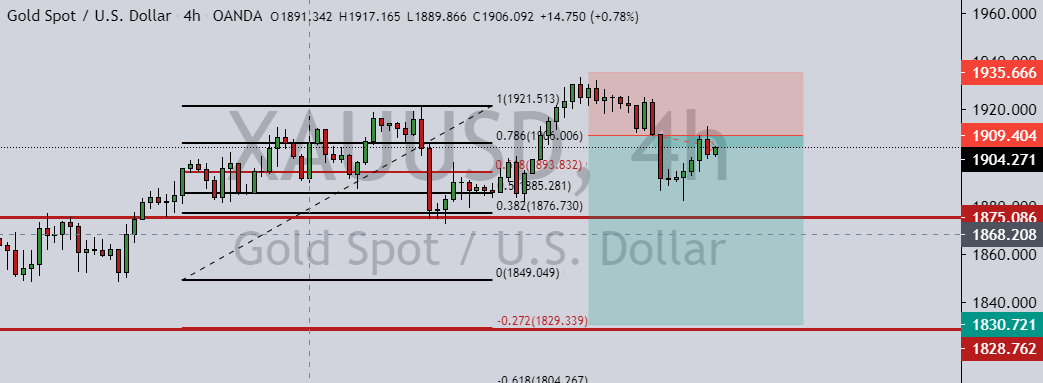

Tuesday's analysis noted resistance between a 50% and 61.8% retracement area in the $1,909 level:

-637382164812413600.png)

The setup was illustrated as follows on the 4-hour time frame:

-637382165070251916.png)

The entry target has been triggered:

There has been a high of 1912.96 (drawdown) so far.

However, the resistance has held up sending the price back to 1900 in the London close.

The stop loss can be moved to breakeven as soon as new resistance structure is formed as the price moves lower and creates new structure.