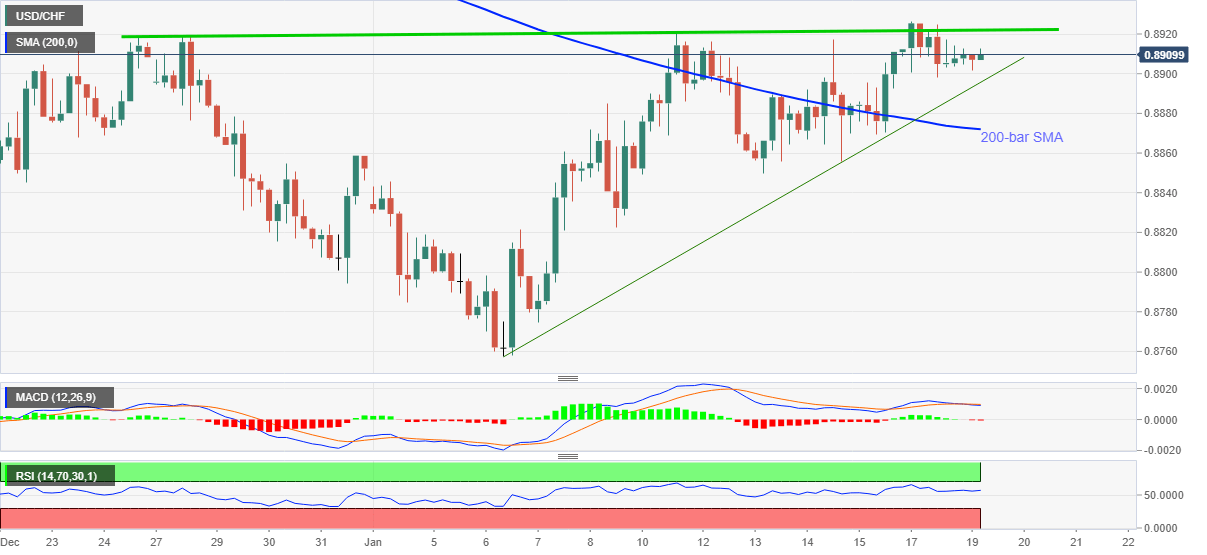

USD/CHF Price Analysis: Bulls eye confirmation of cup-and-handle on 4H

- USD/CHF teases confirmation of a bullish chart pattern, trims early Asian losses off-late.

- Two-week-old rising support line, 200-bar SMA add filters to the downside.

- Bulls can eye December tops on confirming the formation.

USD/CHF picks up bids near 0.8912, up 0.05% on a day, ahead of the European session open on Tuesday. In doing so, the pair flirts with the resistance line of a short-term bullish chart pattern, called cup-and-handle.

Considering the upbeat RSI and absence of strong bearish signals from MACD, coupled with sustained trading beyond 200-bar SMA, USD/CHF is likely to confirm the stated bullish pattern by breaking above 0.8925 immediate hurdle.

Following that, the theoretical target of 0.9080 and December’s high of 0.9093 should lure the USD/CHF buyers.

The early November lows near 0.8980 will offer a tough fight to the bulls following their first battle with 0.8925.

Alternatively, an upward sloping trend line from January 06, at 0.8895 now, offers nearby support to the quote ahead of 200-bar SMA close to 0.8870.

Should the USD/CHF sellers manage to conquer 0.8870 rest-point, 0.8850 and the monthly bottom around 0.8755 will be in the spotlight.

USD/CHF four-hour chart

Trend: Bullish