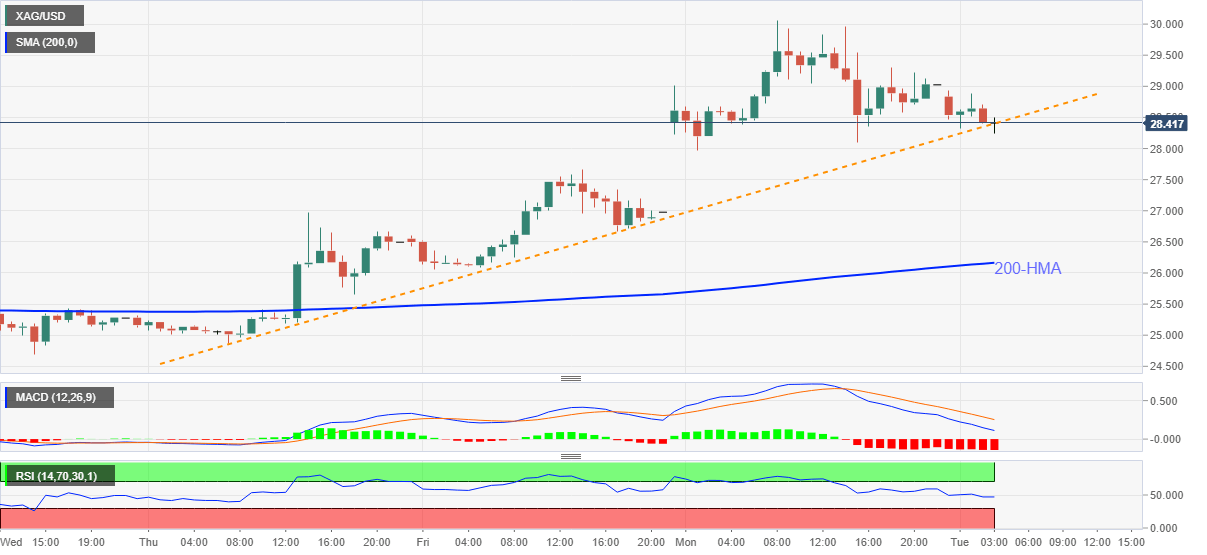

Silver Price Analysis: XAG/USD teases immediate support line above $28.00, aims to fill Monday’s gap

- Silver stays depressed after easing from multi-month top the previous day.

- Bearish MACD favor sellers to break the nearby support line.

- Bulls await a clear break of $30.00 for fresh entries.

Silver flirts with short-term support line while taking rounds to $28.40, intraday low of $28.23, during early Tuesday. In doing so, the white metal extends its failures to keep a brief uptick beyond the $30.00 while flashing 1.33% losses on a day.

Given the quote’s pullback from the key psychological magnet, coupled with the bearish MACD, silver is more likely to break an upward sloping trend line from last Thursday, at $28.40 now.

Following that, Friday’s close near $26.98 will be on the seller’s radar ahead of the 200-HMA level of $26.16.

On the flip side, $29.30 can test the intraday’s upside momentum before highlighting the $30.00 threshold on the silver bull’s radar.

Should the bullion stay positive above $30.00, the late January 2013 low near $30.75 will be in the spotlight.

Overall, the white metal is likely to witness downside pressure but the bulls shouldn’t leave hopes.

Silver hourly chart

Trend: Pullback expected