GBP/USD Price Analysis: Aims for 1.3950 key hurdle after snapping three-day losing streak

- GBP/USD picks up bids following its bounce off 1.3809.

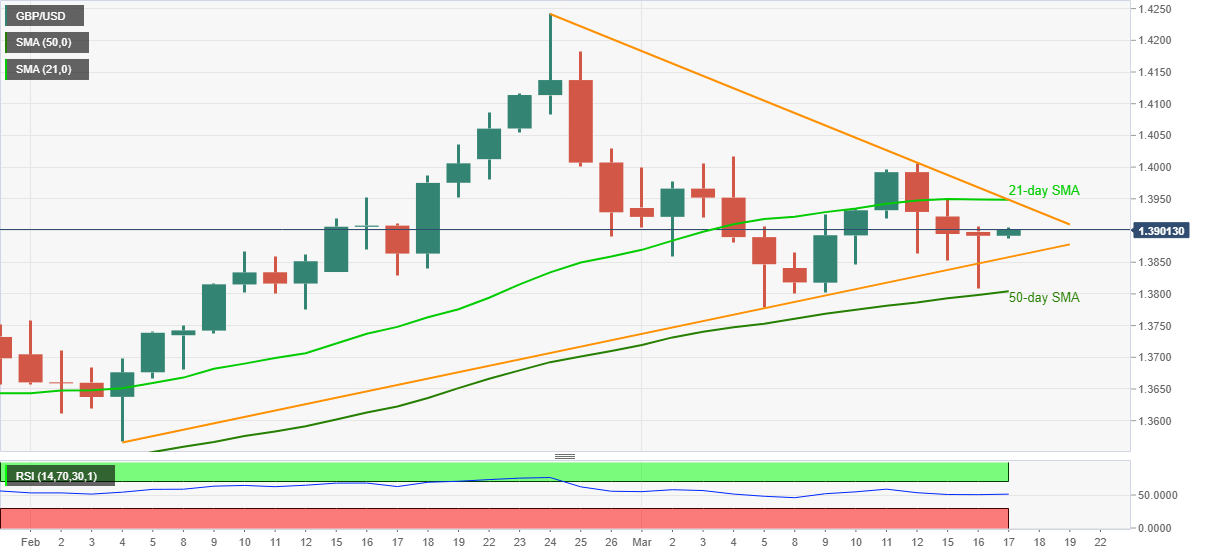

- Convergence of 21-day SMA, three-week-old falling trend channel challenges the bulls.

- Ascending trend line from early February, 50-day SMA restrict short-term downside.

GBP/USD rises for the first time in four days, currently up 0.10% around 1.3905, during Wednesday’s Asian session. In doing so, the quote justifies a U-turn from a 1.5-month-long rising support line, portrayed the previous day.

Given the lack of overbought RSI conditions, not oversold as well, GBP/USD buyers are likely rushing towards a confluence of 21-day SMA and a descending trend line from February 24, currently around 1.3950.

However, any further upside will be decisive for the cable buyers. It should be noted that the 1.4000 threshold, also comprising the previous week’s top, offers an extra filter to the north.

On the flip side, a six-week-long rising support line around 1.3855 becomes an immediate challenge to the GBP/USD sellers ahead of highlighting a 50-day SMA level of 1.3804 as the key short-term support.

In a case where GBP/USD drops below 1.3804, it needs to break below the monthly low of 1.3778 to convince the bears.

GBP/USD daily chart

Trend: Further recovery expected