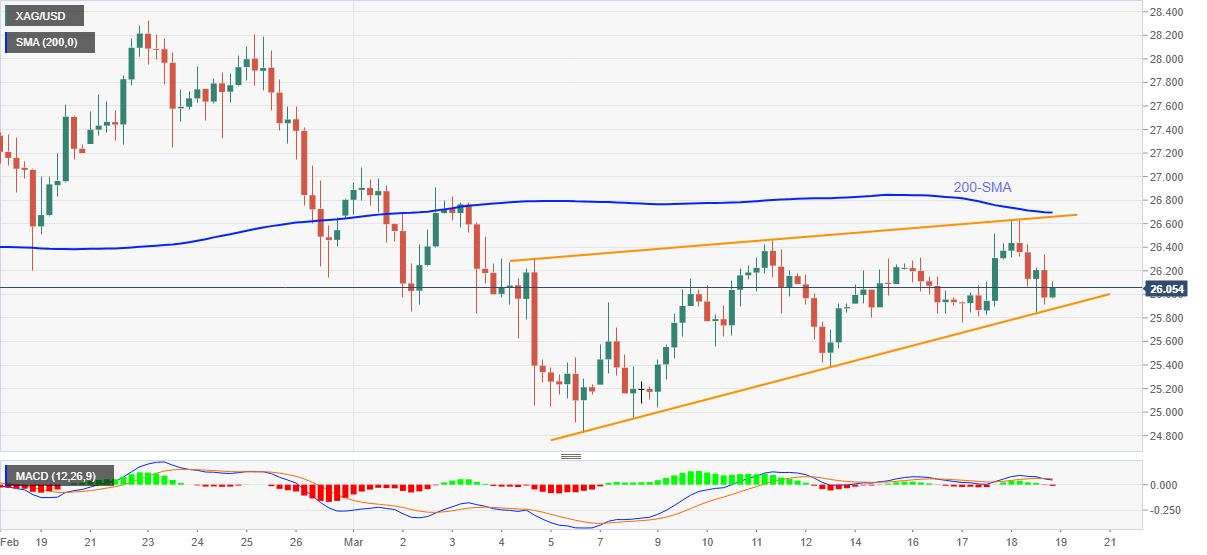

Silver Price Analysis: XAG/USD sellers stay hopeful around $26.00 on short-term rising wedge

- Silver consolidates recent losses inside a bearish chart pattern.

- Downbeat MACD signals, sustained trading below 200-SMA also favor silver bears.

Silver holds onto the previous day’s recovery moves, following its pullback from the monthly top, near $26.10 during the initial Asian session on Friday. In doing so, the white metal stays near the support line of a short-term rising wedge bearish chart formation on the four-hour play.

Although the sellers’ favorite chart is yet to give confirmation, bearish MACD signals and the commodity’s sustained trading below 200-SMA suggest underlying weakness in the momentum.

As a result, silver bears await a decisive break below $25.85 to confirm the chart formation and eye for the yearly bottom surrounding $24.20.

However, the monthly low of around $24.80 may offer an intermediate halt during the fall.

Meanwhile, recovery moves can target $26.50 but any further upside will be probed by the upper line of the stated wedge, stretched from March 04, as well as 200-SMA, respectively around $26.65 and $26.70.

If at all silver buyers manage to conquer $26.70, an upward trajectory to $27.30 and late February top near $28.35 can’t be ruled out.

Silver four-hour chart

Trend: Pullback expected