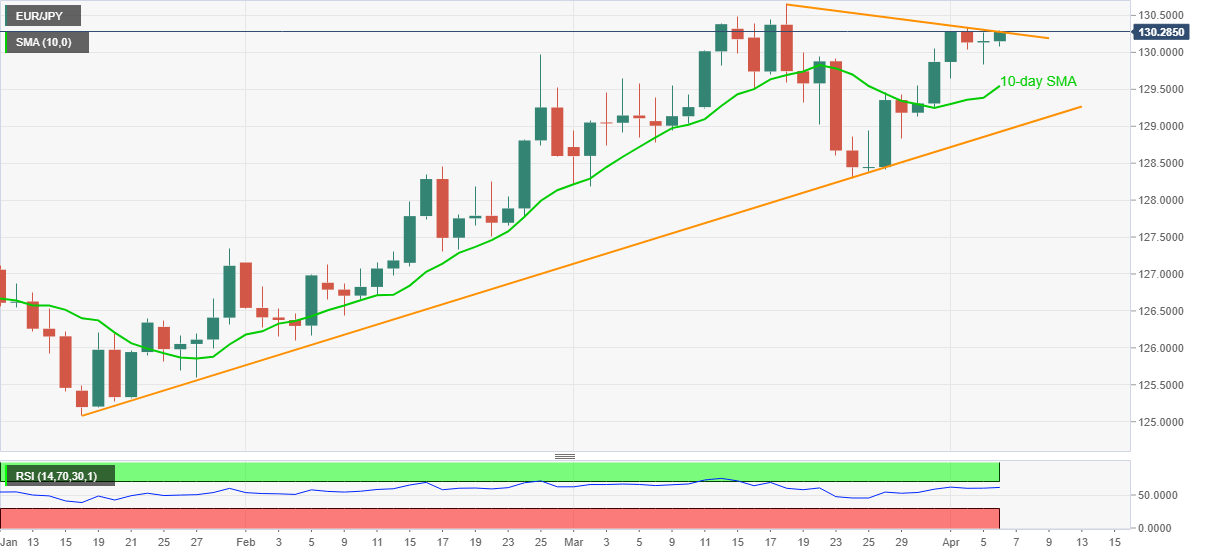

EUR/JPY Price Analysis: Monday’s Dragonfly Doji keeps buyers hopeful above 130.00

- EUR/JPY buyers attack 13-day-old resistance line after flashing a bullish candlestick the previous day.

- Upward sloping SMA, strong RSI line favor the bulls.

- Bears need to break an ascending support line from January 18.

EUR/JPY picks up bids around 130.26, up 0.08% on a day, during Tuesday’s Asian session. In doing so, the pair respects the previous day’s bullish candlestick formation, Dragonfly Doji, amid upbeat RSI conditions.

While the 130.30 immediate hurdle, comprising a downward sloping resistance line from March 18, is on the cusps of an upside break, the previous month’s top, also the highest since October 2018 near 130.67, will be the key to watch afterward.

Although RSI might have turned overbought by then, which in turn suggests pullback, any further rise past-130.67 will not hesitate to cross the 131.00 threshold.

Alternatively, a pullback from the current levels needs to slip beneath Monday’s low of 129.83 to defy the bullish candle. However, the pair’s consolidation towards the 130.00 can’t be ruled out.

It should, however, be noted that the EUR/JPY sellers will remain cautious before breaking an ascending support line from mid-January, around 128.90. Though, fresh short-term selling could be initiated on the downside break of 10-day SMA, near 129.50 by the press time.

To sum up, EUR/JPY remains on the bull’s radar and is ready to escalate the run-up but a rally in the prices is less likely.

EUR/JPY daily chart

Trend: Bullish