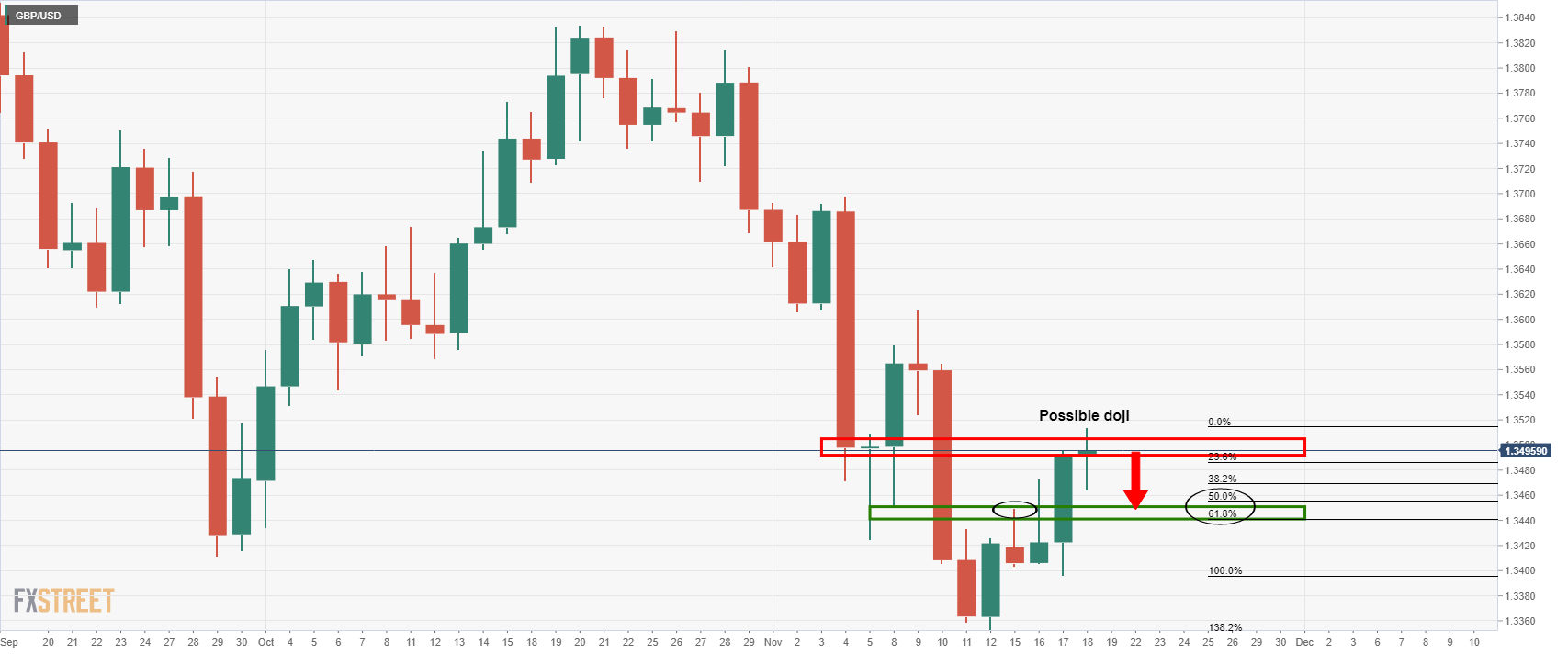

GBP/USD Price Analysis: Bulls face a wall of daily resistance

- GBP/USD bears are seeking a test of the W-formation's neckline.

- The bulls are expecting a breaking of daily resistance.

GBP/USD has caught a bid in the New York mid-day session while traders assessed whether or not recent gains linked to expectations of a central bank rate hike had gone too far. The sensing has flipped risk-on, however, which has sunk the US dollar and given the point another boost. With that being said, the bulls are facing a wall of daily resistance and this leaves the W-formation a compelling scenario for the sessions ahead.

GBP/USD daily chart

The price is forming a doji topping candle on the day so far, meeting resistance. This could give rise to a move to the downside for the end of the week.

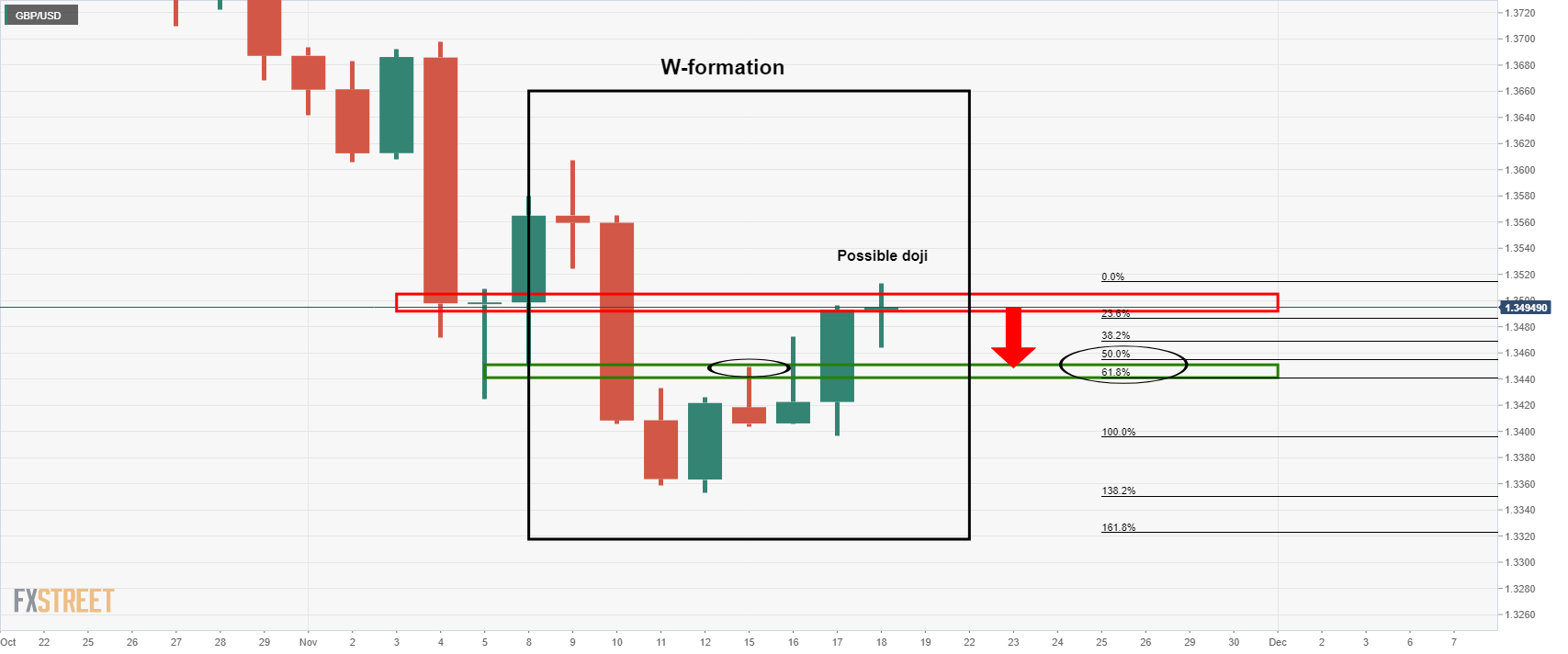

Meanwhile, this is occurring while a W-formation is taking shape as follows:

A W-formation is a reversion pattern and the price would be expected to retest the neckline. The neckline has a confluence with the 50% mean reversion level near 1.3455.