US Dollar Index challenges daily highs near 96.30

- DXY gathers steam following November’s Payrolls.

- The US economy added fewer jobs than expected last month.

- The ISM Non-Manufacturing, Factory Orders come next in the docket.

The greenback, in terms of the US Dollar Index (DXY), gathers some pace and retests the daily highs around 96.30 at the end of the week.

US Dollar Index bid post-NFP

The index now advances for the third session in a row on Friday and looks to consolidate the rebound above the 96.00 barrier following the release of November’s US labour market report.

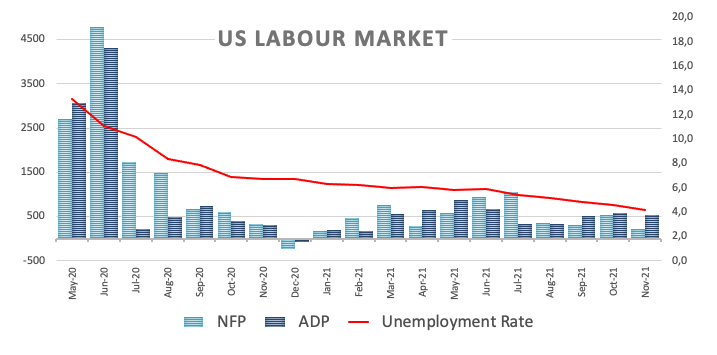

In fact, US yields and the dollar edge higher despite the US economy added “just” 210K jobs in November (vs. 550K estimated), although the jobless rate ticked lower and Average Hourly Earnings surprised to the downside at 0.3% MoM and 4.8% YoY.

In the meantime, yields across the curve add to gains seen in the second half of the week, with the 2y note flirting with tops around 0.65%, the belly advances past 1.45% and the long end approaches 1.80%.

The dollar remains on track to close the sixth consecutive week with gains, always underpinned by the uptrend in US yields, auspicious results from US fundamentals – which in turn support the idea of a strong recovery – a pick-up of risk aversion on omicron fears and lately by the hawkish twist in Powell’s testimony after he suggested the Fed will discuss adopting a quicker tapering pace at the December meeting, all pointing to a rates lift-off at some point in mid-2022.

Closing the weekly calendar, Markit will publish the final Services PMI seconded by the ISM Non-Manufacturing.

US Dollar Index relevant levels

Now, the index is gaining 0.10% at 96.22 and a break above 96.93 (2021 high Nov.24) would open the door to 97.00 (round level) and then 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.51 (weekly low Nov.30) followed by 94.96 (weekly low Nov.15) and finally 94.44 (low Nov.18).