NZD/USD bulls stay in charge towards daily 'breakout' resistance

- NZD/USD bulls stepping in to take on daily resistance.

- Risk-on sentiment prevailed into the closing bell on Wall Street.

NZD/USD is holding in positive territory on Thursday with the bulls in charge in the main as we move over to the early Asian session in holiday thin markets. At the time of writing, NZD/USD is trading at 0.6828 and up 0.32% on the day following a rally from 0.6795 and reaching a high of 0.6842.

Risk sentiment has been on solid footing in the remaining days before Christmas, sending the greenback lower and away from the 97 figure, (as per DXY index), territory that was last seen mid-December when the index reached 96.90. The DXY is an index that measures the US dollar vs 6 major currencies. The kiwi is not one of them, but it tends to track the Aussie which has been performing well this week so far.

The US dollar, as measured by the DXY index, is losing ground as the day progresses into late trade in North America. The index made a low of 95.99 from a high of 96.277 within the sideways channel/daily wedge formation:

DXY daily chart

The recent covid-variant news has lifted investors' spirits where otherwise, markets have been worried by a combination of virus fears, tighter policy, and a bleak outlook for US fiscal stimulus.

Santa Claus rally plays out

US stocks, fuelled by more drug makers announcing that their COVID-19 preventives retained protection against the omicron variant, were closing all-time closing highs in the S&P 500.

The S&P rose 0.6% to 4,725.78, up 2.3% in the holiday-shortened week marking three straight daily gains reversing losses in three prior sessions. The Nasdaq Composite advanced 0.9% to 15,653.37 and the Dow Jones Industrial Average gained 0.6% to 35,950.63, but those indices remained below record highs set in November.

Meanwhile, the 10-year US Treasury yield rose to 1.50% on the last full day of trade in the bonds and stocks before Xmas Eve, (the bond market was to close at 2 pm ET ahead of a market holiday Friday, while the stock market was slated to remain open until 4 as usual but it seems it will be closed in observation of Xmas day that falls on a Saturday).

NZD/USD technical analysis

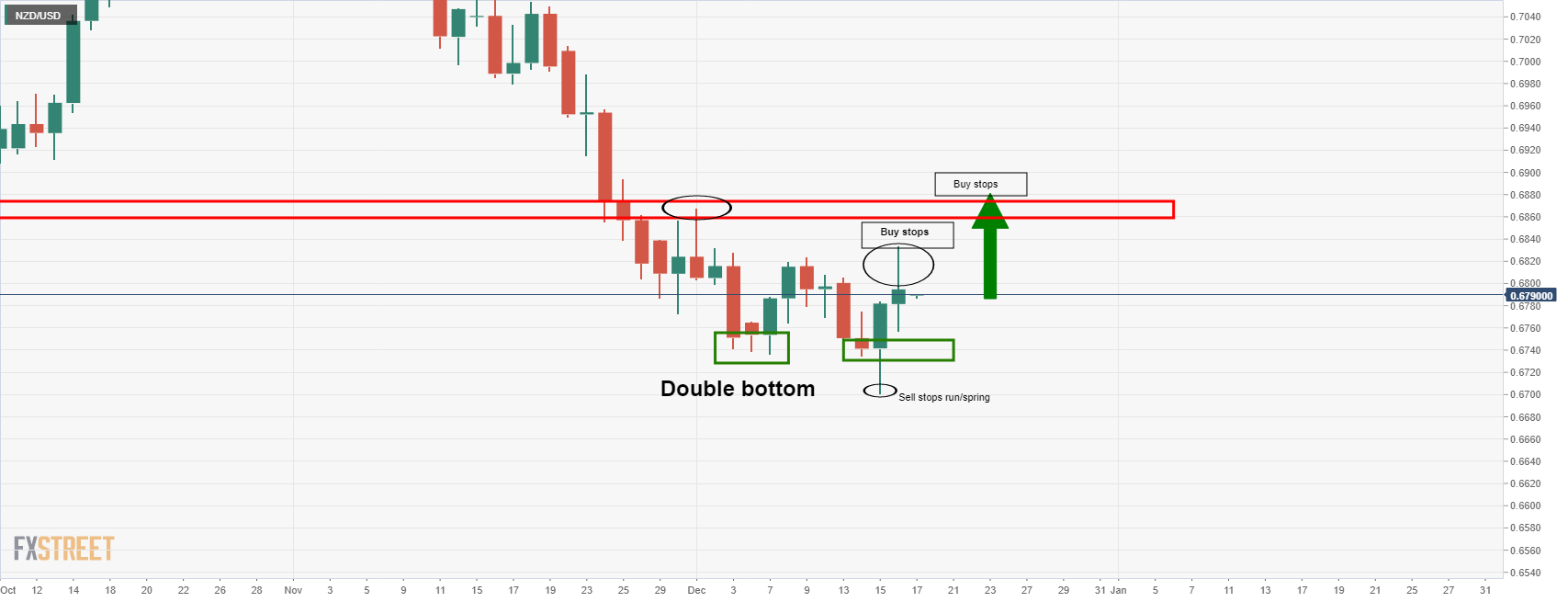

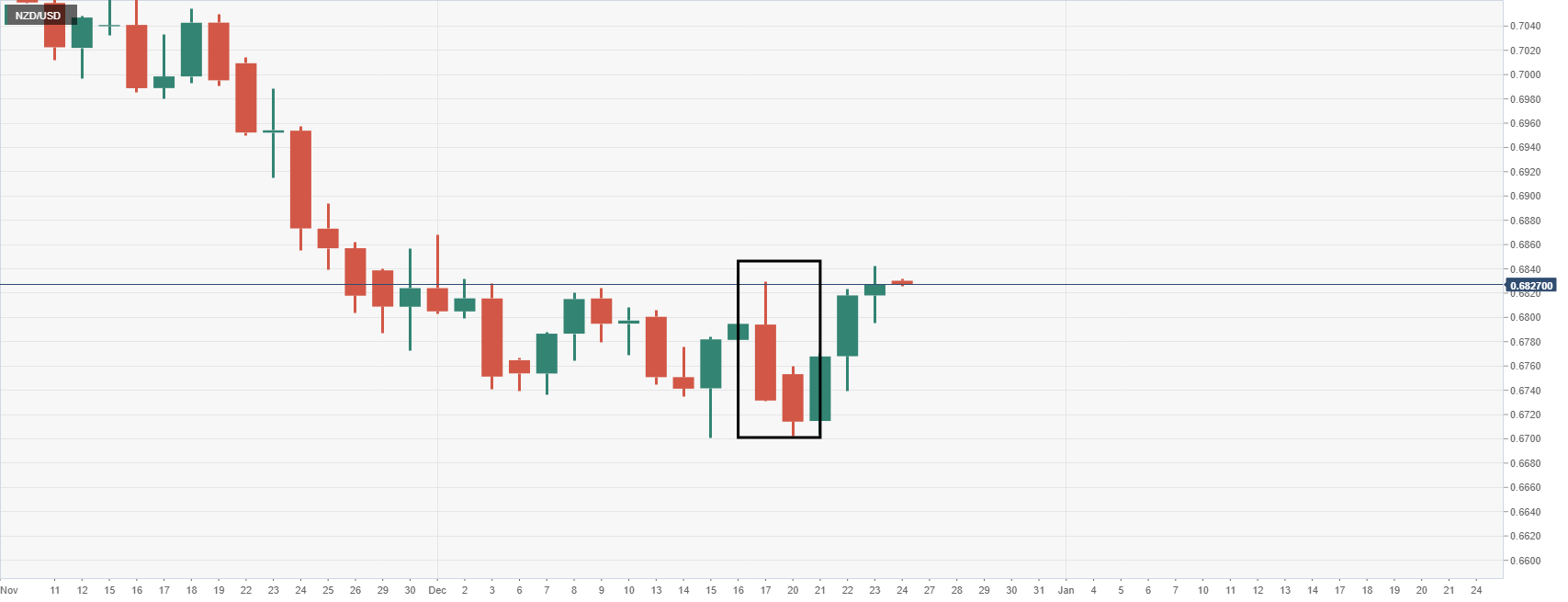

As per the prior analysis above, the daily chart is taking the shape of a Wycoff consolidation. It is yets t be seen if this is accumulation or redistribution, but we have seen further manipulation of the lows as follows:

This was followed by three higher closing candles which indicate that there are strong hands on the buy-side and there are expectations of a breakout: